Prices rise to $35/ton in 2050 as demand increases from companies needing to achieve net-zero goals. Offsets will cost just $13/ton at that point, valuing the market at a mere $15 billion. In this scenario, supply (4.5GtCO2e) would be almost four times greater than demand (1.2GtCO2e) in 2030 – with avoided deforestation accounting for 64% of credit created.

BUY CARBON CREDITS FULL

This includes full flexibility around sector, geography, vintage (age) and whether the project avoids or removes carbon.

BUY CARBON CREDITS FREE

The structure of today’s market is unsustainable: In BNEF’s voluntary market scenario, companies are free to purchase any type of offset they’d like to meet behavioral and fundamental demand, similar to how today’s market functions.

This type of demand is less price elastic and takes over long-term, but hinges on companies sticking to their targets and financials enforcing this among their portfolios.ģ. BNEF’s baseline projection has fundamental demand increasing to 1.1 billion tons (GtCO2e) in 2030 and 5.4GtCO2e in 2050. It will be replaced by fundamental demand as companies work towards net-zero goals, meaning they will need offsets to neutralize any emissions remaining after they’ve reduced their gross emissions. It’s more responsive to prices and criticism, and BNEF expects behavioral demand to drop from 181 million tons (MtCO2e) in 2023 to zero in 2050 in its baseline projection. Long-term, fundamental demand will set the tempo: Today’s fluctuating offset demand is mostly classified as behavioral, meaning companies buy offset to differentiate products or satisfy customers. CBL’s nature-based offset futures, which source from high-quality REDD+ and reforestation projects with co-benefits, opened trading at $14.4/ton in February 2022, but have since fallen to $4.6/ton at the end of 2022.Ģ. At the same time, pricing from the suite of new futures contracts created for the offset market plummeted throughout the year. Investors and the media have taken aim at the quality of credits, specifically in sectors like avoided deforestation, which saw supply tank by 32% in 2022. Supply of such credits grew just 2% in 2021, with 255 million offsets created by projects in 77 different markets.

At the same time, crypto companies that featured prominently in carbon offset buying in previous years were banned from the largest offset registry in Verra, for fear that they further obscure market transparency through tokenization. The offset market shrunk in 2022: Companies bought just 155 million offsets, down 4% from 2021 due to fears of reputational risk from purchasing low-quality credits. The report paints a bullish long-term outlook if several fundamental issues are addressed, which could value the market at $1 trillion annually as early as 2037.ġ.

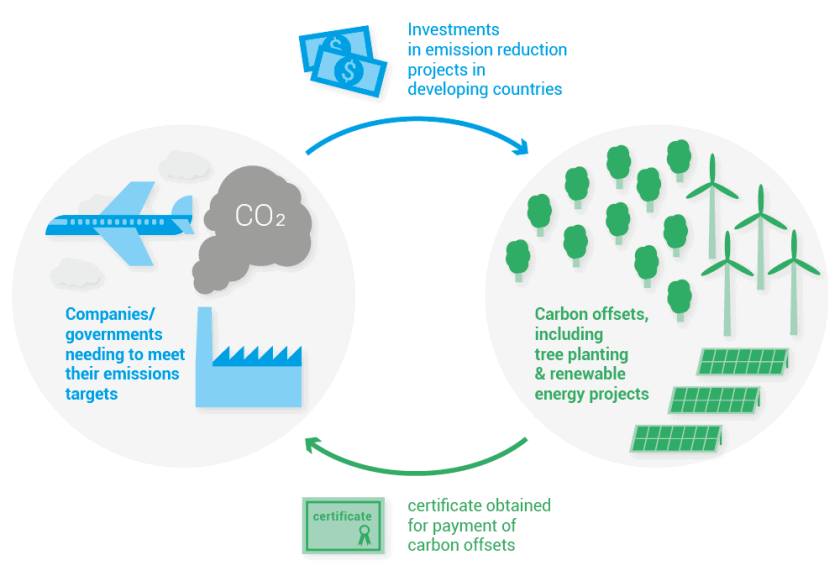

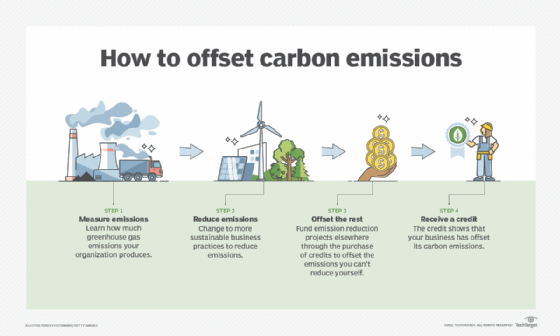

BloombergNEF’s 2023 Long-Term Carbon Offsets Outlook provides a round-up of a turbulent past year for the market, but also forecasts supply, demand and prices under three main scenarios: the voluntary market, removal and bifurcation scenarios. The next few years are a sink or swim moment for carbon offset markets, which allow for the trading of verified emission reduction credits equivalent to one ton of carbon each.

0 kommentar(er)

0 kommentar(er)